Yesterday I attended a NAIOP virtual session, “Researching and Evaluating Market Opportunities: A Two-Dimensional Approach Webinar” that discussed a recent report from their research foundation offering an alternative approach to evaluating commercial real estate development opportunities. In the webinar, the creators of the report guided attendees toward interpreting the format for their analysis and how it helps investors and developers identify target markets faster and with more reliability to maximize their opportunity potential.

So what does this mean?

Through looking at data assembled over a 15-year period for office and industrial properties, the aim is to understand where the wisest location to invest or build would be. Although the report is focused on office/industrial market segments, there could be application to other property types as well. Each situation accompanies different investor/developer objectives with their own risk tolerance and return criteria. This assessment also incorporates market dynamics and external environments being weighed in – for example, who would have predicted the pandemic and the resulting affects on our local/global economies?

Inputs for Specialization and Customization

The outcomes of reports will shift based on the client, property type, available data, and statistical methodology. For instance, the webinar highlighted the following examples:

Client Property Type Data Variables Statistical Methods

Investors Office Size/reliability Standard deviation

Developers Industrial Transaction volume Variance

Local/regional officials Retail Pricing Logarithmic scaling

Multifamily Opportunity/cyclical

Capitalization rates

Two Dimensional Reporting

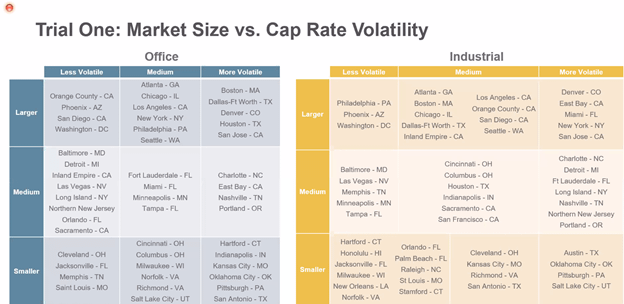

Charles Warren, one of the authors of the report, described the concept of two-dimensional reporting to evaluate a development opportunity. In this situation, the Y axis represents market size (total inventory) and price (asset price), while the X axis represents volatility (variation in price) and liquidity (variation in number of transactions). The below diagram ranks different markets on this basis to explore the question “Am I safer in a larger market?” The answer: there is no correlation between a price risk and market size.

Finding #1: Price risk is not isolated to certain markets. Size is not a proxy for risk.

Finding #2: Investors paying a premium to own assets in markets that are larger – is this less likely to see liquidity risk for a buyer of a distressed asset? Answer: There is little correlation.

Higher prices have more volatility. This suggests that investors aren’t paying a premium price for medium risk. Markets that carry higher highs have a more risk to them.

Finding #3: Lower priced markets seem to be historically less volatile.

Conclusion: The basic idea for two-dimensional grid uses sales volume as a measurement of size on Y axis, then combine composite index of liquidity and price risks as volatility measure on X axis.

This shows smaller markets are more volatile and larger markets are less volatile. The situation also depends on what kind of investor or owner you are. Some with more of an appetite for risk, operating in the smaller markets, may be advanced.

All Signs Point to A Thorough Analysis

The concept of “where there is risk, comes reward” still reigns true. There is never one “point blank” solution to investigating complex markets; however, additional intelligence and due diligence are required to make any informed decision and execute successful investment strategy. The team at NAIOP just offers a very helpful tool to getting there and attending this webinar couldn’t have been a better choice.